2020 hasn’t been an easy year all round for most of us and I know that lots of peoples finances have taken a bit of a battering so, over the next few weeks, I’m going to share a few ways that you can hit the ground running in 2021 with some easy tools to help you manage your money. First up, I’m going to tell you all about how to manage your money with Plum!

*For transparency, I’m not being paid for this post but I have included my affiliate link which means that if you do sign up to try Plum then I’ll receive a small payment. I hope you know by now that I wouldn’t share something I hadn’t used myself and didn’t think it would absolutely benefit you lovely lot**

What is Plum?

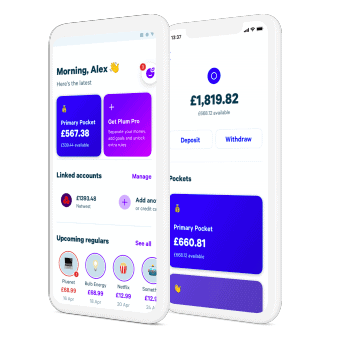

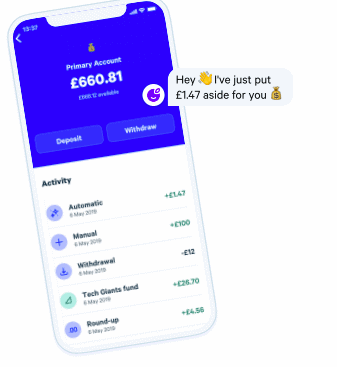

In simple terms, Plum is a super clever little AI app that links up with your bank account and analyses your spending and your regular outgoings and uses that knowledge to help you by putting money aside for you into a separate pot without you having to think about it.

You can tweak your settings so you control how often it moves money across from your bank account and set limits as to how much it moves so you never need to worry about too much money being moved over.

When you’re ready to spend your money then you can love the money back to your bank account with no limits or charges.

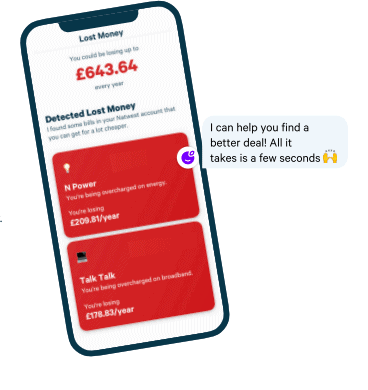

It’s not just the fact that Plum helps you put money to one side that makes me think you’ll love it as much as I do, it also helps you by making sure that you’re not paying too much for your monthly outgoings by analysing what you’re paying for your bills and letting you know if there are better deals out there that you could switch too!

Plum was launched back in 2016 and now has over 1 Million customers who score the app a 4.7 out of 5 so it’s safe to say that there are a LOT of people who are using the app to manage their money better!

Is it safe to use Plum?

Absolutely! I know some people worry about connecting an app to their bank account but it’s just as safe as using your own bank’s online banking or app. If you’ve not heard about Open Banking then it’s definitely worth finding out more about it because the whole purpose of Open Banking was to give UK customers more choice when it comes to managing their finances.

The introduction of Open Banking has brought about lots of new ways to manage your finances and Plum is absolutely one of the ways you should consider – my actual bank is brilliant for lots of things and I have no complaints but there’s no doubt in my mind that Plum are better at what they do for me.

Open Banking means I can use companies like Plum to help me manage my finances safe in the knowledge that I have the same level of financial protection as it would in my bank account.

Read more about Open Banking here.

How much does Plum cost?

The best part about Plum is that it’s absolutely free if you just want to use it for everything I’ve just told you about so it won’t cost you a penny to use Plum to put money to one side and get help with reducing your outgoings.

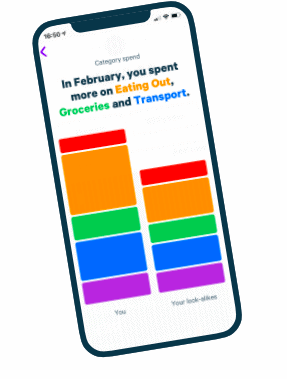

There are some extra options though that you can pay for if you want to unlock more features – they’re not necessary if you want the basics but things like earning interest on your savings and some super fun savings challenges as well as additional autosaves on your payday. My favourite feature of Plum Pro is the Diagnostics tool which looks at where you’re spending your money and categories it with the option to compare yourself against people who also use Plum with a similar financial profile (similar salary, location and age for example) so you can compare your spending to theirs.

<<<Download Plum on IOS or Android here!>>>

Plum is an easy way to manage your money and it’s definitely with checking out to see if it works for you!

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter or BlogLovin and I’d love to see you over on my Facebook page and on Instagram. If you’re interested, you can find out more about me here and while I’ve got your attention, if you’re wondering why some of my posts lately are a little bit less frugal then have a read of this post. 😉

Do your future self a favour – Pin this post for later: