Am I blacklisted? That’s probably one of the most common questions that people ask whenever they’re declined for credit so today, I’m going to let you in on a secret about this mythical blacklist and tell you the real reasons why you might have been declined for credit.

First things first, there is NO blacklist. I repeat, there is NO blacklist.

The credit reference agencies report factual information about your credit file and anyone with who you apply for credit can access that information when considering your application. Each lender will have its own set of criteria for accepting an application and although they’re highly unlikely to share that criteria with you, you can rest assured that applications will be assessed based on that criteria.

Some companies are stricter than others when it comes to approving applications for credit and some may have more relaxed criteria but will charge you a premium for lending to you.

Take car finance, for example, there’s an ad that plays pretty much on repeat on our local radio station that says they can offer almost everyone credit for a car – even those with poor credit history. That’s because they will review your application and match you to a company that is willing to lend to you – the better your credit history is, the more companies there are who will lend to you as you’re classed as a lower risk so your interest rate will be better. If you don’t have a great credit history then your choices are more limited though so you’ll be left with companies who offer bad credit car finance and are willing to take on the risk of lending to you. They may charge a bit more in interest so do take that into consideration when making a decision.

So, don’t ask ‘Am I blacklisted?’ just have a look at these reasons below to find out why you might have been declined…

Check your credit file to make sure you don’t have a financial association with someone

I wrote about this post ages ago along with giving instructions on how to disassociate yourself from someone on your credit file so I won’t go into it too much but you should always make sure your credit file is accurate when it comes to linking you financially to someone else.

Multiple applications for credit

When you apply for credit, your credit file will show that credit search. It won’t reflect that an application has been declined but it will show a search for credit so if you make multiple applications in a short period of time then it looks a bit desperate. Lenders might take that into account and not accept your application even if you have an otherwise perfect credit file.

Are you on the Voters Roll for your current address?

If you’re not on the Voters Roll for your address then this can lead to a declined application as that’s one of the ways that lenders verify you are who you say you are. It can take a good while to update so register to vote as soon as you can after moving.

Don’t use your credit cards for cash too often

There’s nothing wrong with using your credit card to take cash out but it does show on your credit file so if you do it too often then a lender could think you’re struggling with your finances and may decide to decline your application or class you as a higher risk to lend to which would bring an increased interest rate.

Make your payments on time and stay within your credit limits

This is an obvious one but I had to include it! If you don’t make payments on time or you exceed your credit limit then this will be reflected on your credit file and will definitely raise flags with lenders.

Having lots of available credit OR not enough available credit

Even if you aren’t using the credit, it still counts towards your overall credit ‘exposure’ which means that lenders will most likely take it into account when reviewing your application. Your best bet is to close down accounts you don’t need anymore. Equally though, you don’t want to be too close to utilising all of the credit available for you so give yourself a bit of headroom if you can.

Are there any errors in your credit report?

Lenders make mistakes too sometimes so it’s always worth having a quick check of your credit file to make sure everything is as you’d expect. Also, any fraudulent applications in your name would show up on any checks here giving you the opportunity to get things sorted before they get too bad.

How to obtain a copy of your credit file

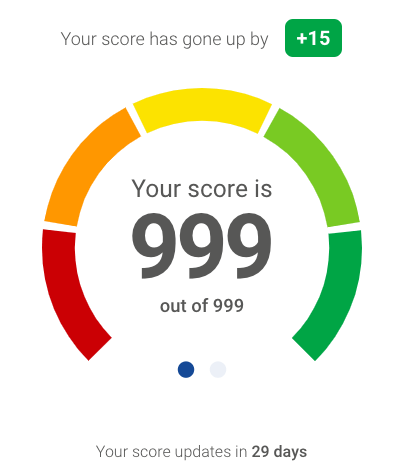

(I love Experian and check my score every month which you’ll probably already know if you follow my Five Frugal Things posts every Friday – I tell you about it all the time so I signed up as an affiliate so if you do sign up then I’ll get a small payment. I think it’s important to say that I am an affiliate because I used their service and knew I’d be telling you about it.)

An Experian free account lets you access your Experian Credit Score for free which is updated every 30 days when you log in. This is the one that I have.

(The Experian free account is available to UK residents aged 18 years or over and subject to identity checks.)

If you prefer to see the full details of your credit file then you can add a CreditExpert paid subscription to your Experian account which will allow you to see your full Experian Credit Report, helping you understand what’s impacting your credit score and how to improve it. It’s also a good way to ensure your information is accurately recorded and up-to-date. It continuously monitors your report, alerting you to certain changes and letting you know about any potential fraudulent activity that it picks up.

There’s a 30 day free trial for the CreditExpert service which makes it ideal for a one-off full check of your credit file. A monthly fee of £14.99 applies after your free trial but you can cancel during your 30-day free trial without charge if you choose not to go ahead with the subscription.

(This offer applies to new customers only and the free trial period starts on registration – further ID verification may be required to access full service.)

So, next time you ask yourself ‘Am I Blacklisted?’ don’t panic, just check your credit file and find out what’s happening!

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter, BlogLovin or Networked Blogs and I’d love to see you over on my Facebook page and on Instagram. Collaborative Post

Why not do your future self favour and Pin ‘Am I blacklisted?’ for next time:

This really helps take some of the stress out of being declined, it makes more sense now.