Every week I share five frugal things that I’ve done during that week just to show you that the small things you do all add up to a great frugal lifestyle where you can learn to live a fabulously frugal life.

Before I start though, I do want to say that being frugal to me is about getting the best value for our money – it’s not about doing without for us or about not having nice things. We all have different financial situations and we’re all frugal for different reasons – we’re frugal so we can afford to do nice things together.

We were on holiday for half the week this week so my first two things this week are holiday related!

1) We tried something new with our holiday spending money and it worked really well!

Basically, we had a set amount saved up for our spending money but we only changed 75% of that amount into Euros, leaving the rest in the bank where we could get it using our debit card at an ATM if we really needed it – not the most cost-effective way if we’d had to use it but we were really hoping not to so it was worth taking the chance. We were hoping we’d be able to manage on less spending money than we’d thought and knowing what we’re like, we knew that the only way we’d do that is if we didn’t actually have the cash with us.

We managed perfectly well on what we took and even came home with €40 leftover so the amount we left in the bank will go towards Christmas. 😉

2) I took two books on holiday with me – the new Sophie Kinsella one and the new Marian Keyes book. Both of which I absolutely loved but thanks to the amount of time I spent relaxing, I finished them both before our journey home.

I hate being without a book and I’d left my Kindle at home at the last minutes as I didn’t think I’d get through both books in the week so I was considering popping to the shop to buy a new book but then I spotted this book in the hotel’s library…

I didn’t just want to take it so I left my two books and took this one to read on the journey home which not only saved me the cost of a new book but it also meant that someone else got to read the books I’d taken with me.

3) Just before we went on holiday, I got a letter from our mortgage provider to let us know about the interest rates going up and since our fixed rate has ended that means our interest rate is going up. That was pretty much expected because we know we need to sort that out and look to get a better deal but we’re considering a few options so we thought we’d just continue as we were until after the Summer and then look at what we wanted to do. In the meantime, we’re overpaying where we can and trying to get the amount down so when we do remortgage we have the best possible LTV amount which should help secure a good deal.

Instead of increasing our mortgage payment though, our clever mortgage company have taken all of our overpayments into account and recalculated our monthly repayments so instead of increasing, they’ve decreased significantly.

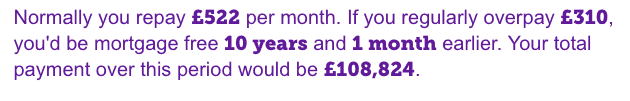

In the past, we would have done a little dance at the thought of a lower repayment but these days we’re much more sensible (sometimes) and as soon as we got back from our holidays, we rang them up and asked them to put the payment up to what it was before so we’re now effectively overpaying by £310 a month. This keeps us on track for repaying our mortgage in the next ten years which is 11 years sooner than planned.

To give you an idea, of how much difference my overpayment will make overall:

4) I’m feeling like such a grown up this week!

It’s not even just the mortgage that we’re attacking at the moment, the next phone call I made after speaking to my mortgage company was to my work where I upped my monthly share contributions at work so I now put in £50 (although that’s pre-tax so it actually costs about £40) and on top of that my work matches that in share purchases so for £40 a month, I get around £100 worth of shares. It’s a long-term thing really though as I think you need to keep it for five years for it to not have to pay tax on it when you take the money out. We have a plan to withdraw after the five years and pay anything we have off our mortgage at that point.

5) I’m not sure if this counts as a separate one to the last couple of frugal things we’ve done this week but it’s the reason we’ve upped our mortgage overpayment and share contributions so I’m going to go with it.

Basically, we had a chat while we were on holiday about all things financial as we were discussing whether we wanted to book next year’s holiday sooner or later and our little chat had me scribbling on a napkin as we finally got something down on paper that we’ve been discussing for a good year now.

We now officially have a ten-year plan which we’d ideally like to become a seven-year plan if can – although that’s only going to happen if we push ourselves. At the end of the ten years, we want to be mortgage free and have vague plans about investments and savings. I say vague as we probably need to take some advice on where we should be investing and saving to get the best returns.

We’re not at that stage yet though as we’re going to massively focus on the mortgage for the next three to five years but the long-term goal is there and we’ll re-look at how we get there in a couple of years once we’ve made as much headway on the mortgage.

We like nice things too much to do without to achieve our goals though so to us, it’s all about balance.

As usual, we’ve been having some really good discussions this week over in our Live Well, Spend Less Facebook group. We’d love to welcome you to our little community if you fancy popping in.

As always, we’d love you to join in with us by sharing your five frugal things from week – whether it’s an Instagram picture (#5frugalthings), a blog post or even a video. Just add your link to the linky at the bottom of this post.

You don’t have to share five things you’ve done, anything thrifty or frugal that you’ve been doing is perfect.

You’re more than welcome to copy and paste the badge above but it would be even better if you could let your readers know that you’re linking up with the five frugal things linky by adding a little line to the bottom of your post like this one:

I’m linking up with this Cass, Emma and Becky in this week’s ‘Five Frugal things I’ve done this week’ linky.

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter, BlogLovin or Networked Blogs and I’d love to see you over on my Facebook page and on Instagram.