Did you know that I have a totally free budget planner just for you to download and use to plan your monthly budget?

I created a basic version using Google Docs when I first started blogging because I got quite a few requests for a free budget planner and ever since then, it’s been linked in my menu bar right up there ^^^ at the top of the page.

(If you haven’t spotted it then you’re probably missing out on some other amazing resources (I get that I could well be biased here) like my free personalised poster maker, my cleaning recipes, my much-neglected food section and even the ‘New to the Diary of a Frugal Family‘ page which is a place to start if you’re new to the blog which you all will have been at some point. ;-))

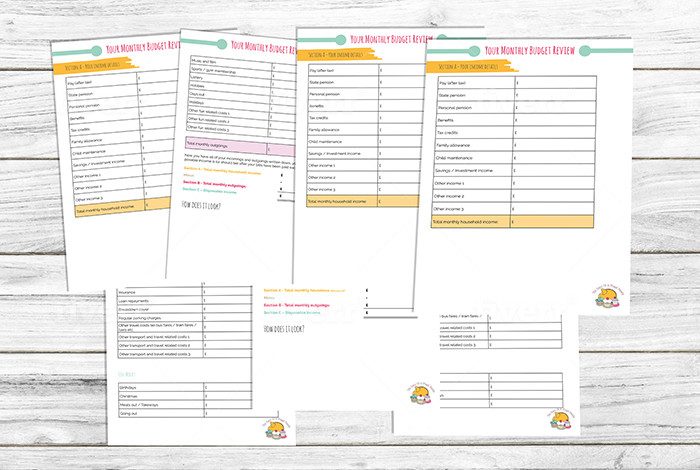

I like a bit of colour in my life so a couple of years ago, I shared a much prettier version of the free budget planner which I love more than I probably should because the colours all match my blog logo colours- superficial I know but there you go.

Since then, my budget planner page has been consistently in my top ten posts but I rarely mention it so today, I thought I’d share it with you in case you didn’t know it was there.

Why do you need a monthly budget?

Without a monthly budget, I’d have no clue how much I had available to spend each month and realistically, I’d have no idea where I was overspending and where I could make savings.

By spending some time calculating my monthly budget, I feel so much more in control!

How to use my free budget planner

Print out the version that you’re going to use – pretty or plain.

Take some time before you start to gather your recent bank statements and anything else that will help you to list ALL of your incomings and outgoings. Try not to estimate any figures as this could mess up all your calculations if your guess isn’t accurate.

The majority of things you need to include are detailed on the budget planner but you also need to write down absolutely everything that’s a regular income or spends. Whether it’s a daily/weekly latte on the way to work, a magazine you buy every month or a monthly takeaway that you say you’ll cut out but never do. 😉 Your bank statement should reveal these little extras so have a good look at each transaction.

For my supermarket and petrol spend, I go through my online banking and add up how much I’ve spent in a month. That’s an eye-opener if you’ve never added it up before, or at least it was for me as it showed me how much those little extra trips to the shops add up.

At this stage, you need to be as honest as possible with yourself – the only people who are going to be affected if you decide not to include things are you and your family.

Once you have all of your incomings and outgoings written down, you can work out what your disposable income is (or should be) after your bills have been paid each month. It’s super simple to work out, it’s basically a case of taking your total monthly household income and subtracting your total monthly outgoings. That leaves you with a figure that *should* be your monthly disposable income.

The amount of disposable income you have leftover determines your next steps. I’d say that most of us could reduce our outgoings in some way no matter how much you have leftover each month. My budget looks reasonable healthy on paper but every time I do a full review of it, I realise that I could be doing more. So no matter how good it looks, I’d recommend that you look at where you could save money by cutting things out completely, reducing what you spend on some things and looking for a better deal on what you do have to pay out each month.

What if I have no disposable income left after working out my budget?

If you have no disposable income left after you’ve worked out your budget then you need to take more drastic action to cut out anything non-essential and make sure you’re on the best deal possible for every bill you pay. You should be meal planning and keeping track of every penny until your situation improves.

You need to do a version 2 of your budget which doesn’t include all of the non-essentials that you can cut out and incorporating any reductions to your bills and shopping budgets. If that makes a difference and give you enough disposable income to manage on then that’s great. If not then it’s time to consider help – a free charity like Step Change or the Citizens Advice Bureau could help you. I can’s stress strongly enough that there are charities and organisations who help you manage your debts without charging you so please don’t get involved with a company who charges you each month to help you.

What if my budget planner shows I should have disposable income but I never do?

This has always been my problem – my budget would show that we should have money left over after paying our bills but in reality, we had nothing.

If this is you then you’ve either missed something off your budget (go back and check everything again) or you spend money without realising on little things that add up. I’d recommend setting up a spending diary to keep track of your spends – that ‘s how I realised (way back when) that I was buying a cheeky Costa every week when I was doing my weekly shop and it was adding up to around £20 a month. I’d never really factored it in as it was just a little treat that I allowed myself – a bit of me-time sitting and relaxing with no-one to answer to – but it added up as it was a regular thing.

You could probably still cut back and almost certainly save on your bills to have even more disposable income so as well as your spending diary then I’d recommend spending some time on that and then re-doing your budget again in a month’s time once you’ve had time to see the savings come in and to work out where your money is going each month.

If my budget planner shows I have disposable income and I do then all is good and I don’t need to do anything, right?

And the last of the possible outcomes from completing your free budget planner is that it shows that you have money left over and your bank balance actually agrees with this. This is the best option as there’s obviously no need to panic and no urgency to do anything to improve your budget.

But, and there’s always a but, you could probably still save money in lots of areas so you would have even more leftover each month. You still need to be as careful with your money as you can be so you can enjoy the odd extra treat here and there and so can start to save for the future more.

So there you have it – my free monthly budget planner, instructions on how to use it and what to do with each of the outcomes that you might get.

What are you waiting for?

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter, BlogLovin or Networked Blogs and I’d love to see you over on my Facebook page and on Instagram. You can find out more about me here.

Pin my ‘free budget planner’ for later:

Discover more from The Diary of a Frugal Family

Subscribe to get the latest posts sent to your email.