Today I’m going to give you some ideas on how to track your monthly expenses which is something we all should (but often don’t) do in one way or another.

![]()

I’ve been blogging for a long time now (I’m a blogging pensioner pretty much) and I must have said how important it is to track your monthly expenses at least once a month because how can you know where you need to cut back and where you can afford to spend a little more if you don’t know where you’re at right now! It’s also the only foolproof way to know exactly where your money is going every month so when you get to the end of the month, your bank balance isn’t a surprise!

In its most simple terms, tracking your monthly expenses means having an up-to-date, accurate monthly budget and then on top of that, writing down everything you spend during the month.

If you do it right and are honest with yourself then you’re going to be so much more confident about your financial situation!

How to write your monthly budget

I have a free monthly budget planner template that you can print out to use as a starting point for your budget planning and if I were you, I’d sit down with your online banking open at the statements page and I’d go through all of your transactions for the last couple of months.

You’ll obviously come across all of your Direct Debits but you’ll also start to see a pattern with some things that you buy regularly enough that you can decide whether to add them into your actual budget or make an effort to cut back. If it’s regular spending that you’ve no intention or desire to change then it should be in your budget.

The idea is that you get everything down on paper so you know exactly what your budget looks like at that moment in time. This is your monthly budget and a starting point for improving your finances.

You should be able to see right now how much money you have for the rest of the month after your monthly bills are paid.

How to track your monthly expenses

That money that you have leftover is your disposable income – it’s the money you have to use for anything that’s not part of your budget so you might want to consider how to split that so you don’t run out of money. I used to use cash envelopes but now it’s all about contactless and card payments so I use my Starling bank account to split my money into pots. I have petrol, shopping, Christmas and fun money all in their own pots with any leftover in the main account.

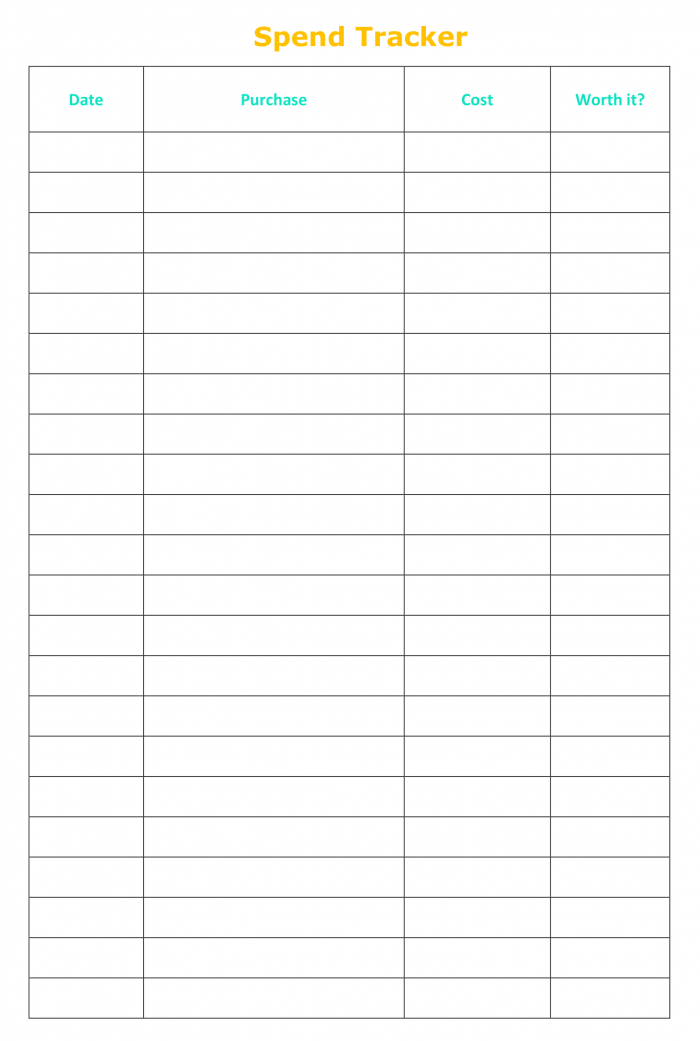

To keep track of everything else that you spend, at least for the first month or so then I’d recommend writing down everything you buy – either on the back of an envelope, in your favourite notepad or this little spend tracker printable! Once you have a good month or so of spending data then you can spend some time and look at where you can cut back or maybe add some more things into your budget if you realise you’ve missed regular spending.

Once you have a good month or so of spending data then you can spend some time and look at where you can cut back or maybe add some more things into your budget if you realise you’ve missed regular spending.

Obviously, the more money you have in your disposable income pot, the more you can spend on extra bits and bobs so never feel guilty about the things you choose to buy and treat yourself to. That’s something that I struggle with sometimes because I know I can be much spendier than I used to be (do you like my new word?) but equally, I know I can afford it so I try not to feel guilty if that makes sense.

You might be able to look at your spending and find cheaper alternatives- for example, if you do a class every week and pay weekly, are you able to do a more block booking to save money or if you know you buy something every week then can you buy in bulk and save.

You could also look at whether a loyalty card would save you money. Places like Nandos, Starbucks and Subway do loyalty cards where you accumulate points every time you spend in there and you can redeem them for free food or drinks when you get to a certain level of points.

This will help you get a real picture of your spending which in turn will help you assess where you can make changes and where you can get better deals.

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter or BlogLovin and I’d love to see you over on my Facebook page and on Instagram. If you’re interested, you can find out more about me here and while I’ve got your attention, if you’re wondering why some of my posts lately are a little bit less frugal then have a read of this post. 😉

Do your future self a favour – Pin ‘how to track your monthly expenses’ for later:

![]()