As someone who wasn’t that great at managing money when I left home (and for way too many years afterwards) I want my children to be as well equipped as possible to manage their finances and their household budgets when the time comes.

The schools have enough to cover in the short period of time the kids are there so even though they might briefly cover some aspects of money management, the bulk of the responsibility falls to me as a parent and I’ve been teaching them as much as I can since they started nursery (and probably before to be honest).

It can be a fine line though between teaching them what I think they need to know and teaching them too much at an early age and making them worry about money. Master Frugal for example is very conscious about money when we’re trying to buy him a treat and will often say that something’s not worth the price or that he doesn’t really need it (his sister not so much ;-)).

If you’re struggling with how to teach your child about money then I really would urge you to get online and do some research as this is a subject that will benefit more children more than half the things they teach them in school yet it gets very little lesson time.

There really is so much to teach your children when it comes to money but these are the main things that I’ve focussed on so far:

Setting a good example

It’s a fact that our children learn from our example so if they see us wasting money or making poor financial decisions then no matter what we tell them, they’ll always have that in their mind. Setting a good example is the first step to teaching your children how to manage money.

Give them enough pocketmoney

In my mind the pocketmoney actually needs to be enough for them to actually learn to budget – a couple of pound a week is great but it’s probably only going to buy a magazine or a few sweets these days so if you really want them to learn how to budget their money then they need enough to be able to set some aside to save as well as buy themselves something small. Plus, these days the things they’re saving up for can cost so much that if they’re only saving a very small amount then they’ll get disheartened so do try to make a deal with them that you’ll pay so much towards whatever they’re saving for if they save a set amount.

Involve them in decisions

By involving children in decisions about money, you’re giving them the chance to think about the value of money and whether something is worth buying if it means cutting back elsewhere. For example, we set aside some money each month for family fun but it’s not a huge amount so we need to be careful what we spend it on and make sure we budget enough to do what we all want to do. The kids know that a day out at a theme park will eat a huge chunk of our budget so they decide whether they want to do that or use the money on other things.

Be honest with them

If you can’t afford something then be totally honest and explain that. Children understand these things and I find that being honest about money is the best way to get them to understand that I’m not just being mean but I really don’t have the money for everything they want.

Teach them to value their possessions

This is an important one as children need to value the things they do have and appreciate that it may not always be the best of something or the most expensive but that it is always the best we can do for them. When we’re done with something, we will either give it to charity or sell it on where possible. Equally they need to know that second hand is often just as good as brand new – a lesson they’re learning well judging by their love of car boot sales.

These are the lessons that you can teach them easily in your day to day life without any resources and they’re all super important but what about the lessons that really get to the nitty gritty – the calculating and comparing of discounts, working out what’s a better buy and even things like understanding profit and loss. These are the lessons that you might want a little help with.

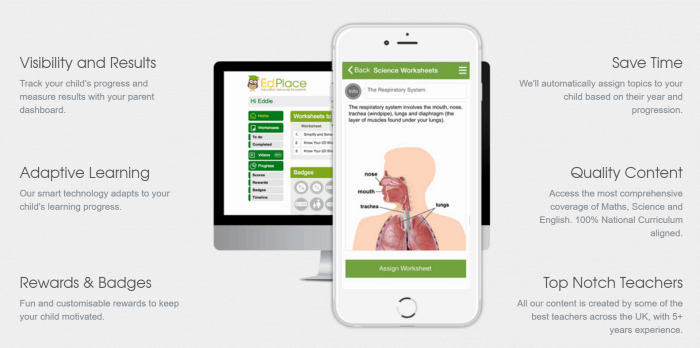

A site that you might like is EdPlace which has a brilliant section on Managing Money in their Summer Camp programme. EdPlace are an educational resource for parents and they have 1000’s of resources across the main subjects and they’re all aligned to the National Curriculum so we know we’re helping our children and not confusing them with different work.

The EdPlace website has some great suggestions for teaching your children about managing money from Year 1 upwards with worksheets and lessons that you can use to help support their learning where necessary.

Looking at the lessons they have suggested for my children’s ages they are perfect and just what we’ve been doing but in a more structured way. They have calculating discounts for Master Frugal who’s just leaving Year 6 and some help in calculating percentages for Miss Frugal which is much needed for both me and her.

I strongly recommend checking out the ideas and lessons on EdPlace – you can find the Managing Money section here.

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address to the box on the top right of this page and hitting subscribe. You can also find me on BlogLovin, Yummly and Networked Blogs and I’d love to see you over on my Facebook page and on Instagram.