Welcome to this week’s money makeover which is all about sorting out your spending. In case you missed the first money makeover post, I’m going to be doing a post every Monday with ways to save money. I’m going to leave you each week with a little task or a change to make and although you don’t have to do everything, please do join in where you can and hopefully, you’ll start saving.

First of all, did you do your homework last week? I’m guessing a lot of you did because the number of people who downloaded the free budget planner has gone up massively

Gold stars to all of you who have done it and if you haven’t, then I really do recommend you do take some time out to work out your monthly budget. You can find the details last week’s post here.

If your budget shows that you don’t have enough money to pay everything each month then please, don’t ignore it – no matter how tempting that might seem. The sooner you take action, the easier things are to deal with. Have a read of this post here if you need some advice with what to do if you don’t have enough money to pay your bills.

If the amount of money you should have left each month doesn’t bear any resemblance on how much money you actually have each month then it’s a good idea to keep a spending diary for a little while where you write down EVERYTHING you spend money on. It might seem like a faff on but it’s the best way to see where you’re spending your money and also makes you very aware of how quickly your spending can add up.

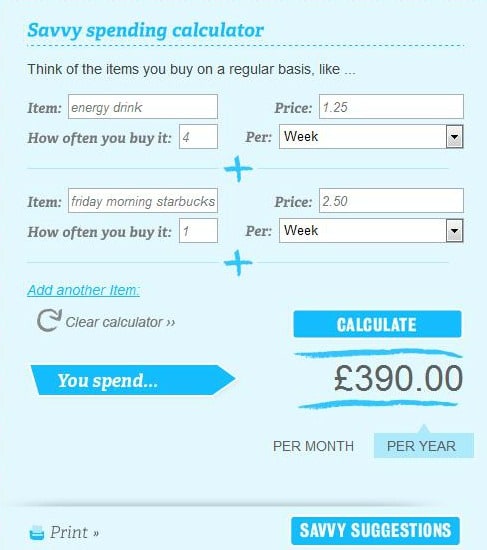

You might be surprised to see how your spending on ‘little things’ can add up really quickly. I use the calculator over at My Family Club to see how much my spending adds up to and seeing how much money I would spend on something over a year really helps motivate me to cut it out of my spending. When I was trying to get Mr Frugal to cut out his early morning energy drink, I used this to show him how much he was spending on it over a year. Unfortunately, he then made me take into account my Friday morning Chai Latte!

That’s a big saving just for cutting out an energy drink and a weekly Chai Latte drink. You don’t even have to cut them out completely, you can either cut down or consider swapping to a different, cheaper brand to save.

Now we’ve sorted that out, let’s think about how much you spend on food shopping. This is the area where you can save the most money in the quickest way if you’re clever. Start by meal planning if you don’t already – you can find lots more information over on my meal planning blog but the main post you should read is What is Meal Planning?

And when you’ve written your first meal plan and you’re at the Supermarket armed with your very organised shopping list, consider changing the way you shop by buying the cheaper brands. For example, at the moment Tesco sell their value pasta at 29p for a 500g bag whereas their standard range pasta is 95p for a bag of the same size. The premium brands like Napolina are priced at £1.30+. If you drop to the next band down for everything in your shopping trolley you could save a fortune and we couldn’t taste the difference in the vast majority of things we’ve done this with if I’m honest (tomato sauce and mayonnaise are the ones we stick to premium with).

This week’s money saving homework task – if you don’t already meal plan, then I want you to plan your meals for next week and write out your shopping list. Then when you’re at the shop, downgrade at least two things in your shopping trolley from premium to standard range or from standard to value.

Logging you in...

Logging you in... Loading IntenseDebate Comments...

Loading IntenseDebate Comments...

Charly Dove · 586 weeks ago

@domesticgoddesq · 586 weeks ago

intheplayroom 53p · 586 weeks ago

mummyoftwo2 55p · 586 weeks ago

TheMadHouse 92p · 586 weeks ago

maggy, red ted art · 586 weeks ago

Lori · 586 weeks ago

Mammasaurus · 586 weeks ago

Kara · 586 weeks ago

mellissa williams · 586 weeks ago

etspeaksfromhome 41p · 586 weeks ago

Amanda · 586 weeks ago

Penny Carr · 586 weeks ago

adviserblog 44p · 586 weeks ago

liska · 586 weeks ago

carolinmaderjournalist 81p · 586 weeks ago

Jets · 586 weeks ago

Jane · 586 weeks ago

gingerbreadhouse 44p · 586 weeks ago

Emily @amummytoo · 586 weeks ago

fritha · 586 weeks ago

pinkoddy 69p · 586 weeks ago

jenni · 586 weeks ago

hpmcq 54p · 586 weeks ago