You might be good at hunting out bargains, amazing at meal planning and fabulous at being frugal but how are you when it comes to actually putting money aside and saving it? I’ll hold my hands up and tell you that although I like to think I’m quite good about finding ways to save money and hunting out a bargain, when it comes to saving I’ve still got a long way to go. A long way.

So while I’m sitting here planning the family holiday I’d like us to take in August and wondering if we can afford it, I thought I’d share with you the different ways I can think of to save some money – some I do, some I should do and some I’ve done and really should start doing again!

- I find that if I’m saving up saving up for something I need to have somewhere to keep the money separate from the rest of my money so I’m less tempted to use it for other things. Luckily, my bank allows me to set up a couple of online savings accounts that I can give nicknames to and easily transfer money into from my current account. I used to have one called Christmas, one called Holidays and a third one called Rainy Days but somewhere along the line, I stopped using them.

- Which brings me very nicely on to my next tip. If you’re a regular checker of your bank balance online, you could try something I used to do which is to transfer the pence amount of your bank balance into your savings account every time you log on. So if you had £21.79, you would transfer the 79p to your savings account and although it might not seem like much, it soon adds up and you won’t miss such a small amount. I don’t do this now as I don’t go on my online banking so much but when I did, it was brilliant.

- My preferred way right now to save for smaller things though is actually just in a purse that I keep at home (I know not the best way but I like it) because I can just pop any extra money I have into it as and when I have any.

- I’m still continuing with my affordable weekly savings challenge and I love being able to see the coins (slowly) mounting up in the jar.

- All loose change (apart from 50ps, £1 and £2 coins) are emptied out of my purse and out of Mr Frugal’s wallet at the end of most days. We have three pretty vases on the kitchen windowsill so the coins are popped into one of those until all three are full and then we take it to one of those change machines in the local supermarket to cash it in. I know they charge about 8p in the pound but our bank doesn’t have a change machine like some banks do and it’s so much easier to not have to wait till we get so many of each coins before we can bag them up. I then use the voucher we get for my shopping and draw the amount I saved out of the bank to pop in my money purse.

- I pay for most things by debit card these days but one thing I do pay for in cash is my weekly shopping and any top ups through the week. I draw out a certain amount on a Sunday, do my shopping and keep the rest in a separate coin purse in my handbag. Anything I have left over the following Sunday is popped into my savings purse.

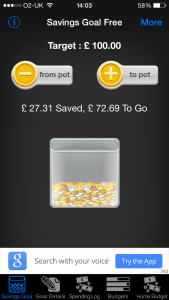

- As far as keeping track of my savings (or lack of), I’m quite visual and it motivates me to see and track my savings which is why I have a free app on my phone called Savings Goals (there’s loads of different ones though so have a look for one that suits you). I add any money I save to the app and then when I click on Savings Goal, it tells me how much I’ve saved in total and how much I have left to save. The app itself could probably do lots more but I just downloaded the free version as that one does all I need it to do really. This is my current update, I’m working towards £100 at the minute to go towards for a night away with my friend:

How do you save your pennies?

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address to the box on the top right of this page and hitting subscribe. You can also find me on BlogLovin, Yummly and Networked Blogs and I’d love to see you over on my Facebook page and on Instagram.

Logging you in...

Logging you in... Loading IntenseDebate Comments...

Loading IntenseDebate Comments...

@EatLikeULoveU · 540 weeks ago

I like the jar idea though, I think I'm going to do that and see how it goes. I try and make lunch every day so I don't spend money on work lunches.

@Lisasbeauties · 528 weeks ago

Zoë · 445 weeks ago

savings · 440 weeks ago

buildnow gg · 55 weeks ago