We’ve all heard the saying that ‘Money won’t buy you happiness’ and although I completely agree with that, I also can’t deny that having money certainly makes like a lot easier! For that reason, I want my children to leave home (not yet but one day ;-)) with a healthy attitude to money and to be able to budget and save and do all the grown up money stuff that it took me years to figure out after I left home.

As I was trying to list some of the things I do to with my two to help them learn about money, I actually realised that I do more than I thought I did and I bet you’re the same – some things I do consciously because I think there’s a lesson to be learned, some I do without realising and some things just happen in everyday life.

- Your children are learning from you every single day – the way you deal with money yourself, the way you talk about money and your whole attitude towards money and material things so in theory, if you set them a good example where money is concerned then they’ve got a better chance of developing a similar attitude. I’m open and honest with them about how much we get paid and how much our bills are and I make sure that they know that although we’re not really struggling, we don’t have lots of spare money and can’t afford everything that they want or that their friends have.

2. I often take them with me when we go shopping and we compare prices of the brands the kids like and the cheaper brands and we do a regular (small) shop for our local food bank and the kids never fail to be amazed at how much you can get for your money with the value products. We’ve tried lots of value products – some we’ve stuck with and some we haven’t because we don’t like the taste as much as our regular brand but they’re not brand snobs and decisions are based on taste and not cost.

3. Pocket money is a great way to help them learn to budget, Master Frugal currently gets £5 a week and Miss Frugal gets £10.00 a week which may seem high to some of you but personally, I think that in order to teach them how to manage their own money, they need to have enough money to actually manage if you know what I mean. This post is really interesting if you’re debating how much pocket money to give or even whether to give it at all.

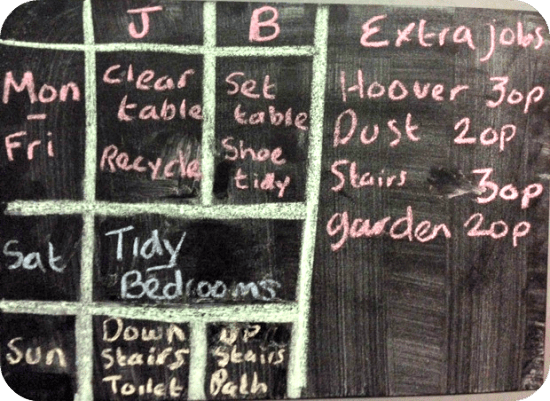

4. In our house we don’t pay the kids for doing their main jobs but we do take away pocket money if the jobs aren’t done and we do have a few small jobs that the kids can do to earn extra money if they want to. We gave our jobs rota a re-vamp a little while ago and it’s working really well for us so I’ll share that in full with you next week but in the meantime, this is the old version where you can see they had very simple jobs that they were expected to do.

I can totally see the benefits to doing this the other way around though and linking money more to doing jobs so it’s whatever works for you and your family. Alice from Life as Alice says that her son Rhys has been doing chores for money since he was at school, he used to put his earnings a pot and counted it out each time he needed anything which has made him appreciate how much things cost. Now he’s a bit older they do it slightly differently….

He now has a GoHenry card which means he has to pay for things on his own card, the money goes straight in and we can tick off his chores on the app, meaning he still has the same concept, but a grown up version.

5. Once they started getting pocketmoney, I also wanted to encourage them to save so they both have their own fun moneyboxes and the money is emptied out and counted at least once a week. There’s nothing like counting your money and watching it build up to make a child want to save in my experience.

6. We also have Go Henry cards which are brilliant for helping them to budget. You can find our more about what we think about Go Henry here (I wasn’t asked to post about it, it’s just that it works for us so I wanted to share) and if you fancy trying Go Henry yourself you can get it free for three months and also get a £5.00 credit to start you off if you use this link. Just so you know, if you do try it Miss Frugal gets £5 too!

7. Miss Frugal is like me and likes to see her progress towards goals so she has an app on her phone that she uses. I think it’s called Savings Goals Free and it’s a great visual app to help her see how she’s doing and how close she is to her target whatever that may be.

8. One thing that was always instilled into me by my Mum was that pre-owned things are just as good as new most of the time and I’ve tried to pass that on to the kids who love nothing more than having a good morning out at the car boot sale.

9. We value what we own and we know that when we’re finished with it, we can sell it at a car boot sale or on a local Facebook selling site or give it to our local charity shop. I let the kids keep the money they make from selling their own things as well which encourages them even more.

10. I’m always honest and if we can’t afford something, I will tell them rather than make excuses.

11. When I asked some blogging friends what they thought as a priority when teaching our children about money Lix from Me and My Shadow told me about an amazing scheme that her daughter’s school run….

We have a savings account run through school with Credit Union and they get rewarded with certificates in assembly for regular savings (regardless of the amount). It’s a great way to encourage saving for something and makes her realise when she withdraws for something like Summer Holidays how long it takes to accrue it Vs how long it takes to spend it!

I’m not sure if that’s something I could encourage our school to set up but even if not, it has made me think that the kids could do with an actual bank savings account rather than just their piggy banks for more long term savings.

12. Emma from Mum’s Savvy Savings reminded me that even before they’re old enough to really grasp the concept of money, children can start learning through play. She also has a fab post about when the right time is to teach children about money which is well worth a read.

13. Encourage children to pay for things themselves if they want them. Miss Frugal was desperate to try a Graze Box as I got one free from work that she loved and even when I told her it would come out of her own money, she was happy so she’s set up a monthly delivery with the payment coming from her Go Henry account. Helen from The Crazy Kitchen does this too….

When they want to buy something, tell them that they need to use their own money regardless of whether you’re happy to buy it for them or not. I’ve found that more often than not they don’t want it enough to spend their own money on it (that relates to my 13yr old daughter more than the boys).

Which reminds me of this little text conversation I had with Miss Frugal a while ago:

What do you do to help your children?

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address to the box on the top right of this page and hitting subscribe. You can also follow me on BlogLovin or Networked Blogs and I’d love to see you over on my Facebook page and on Instagram.

"I enjoy reading your post guys,,, just keep posting.

Attitude status for Boys"

BEST CLEVER WAYS TO HELP YOUR CHILD DEVELOP A HEALTHY.. Thanks for sharing.

My son's first encounter with the issue of money was Mr. Scrooge (http://www.westendinschools.org.uk/pantomimes). I've had quite the trouble explaining why we must save money but not be like Mr. Scrooge and why he is not a positive example to follow when money is in question. Spending but not overspending for stuff we do not actually need – that is the simplest explanation to money management. So I tell my kids to always ask themselves "is this something i MUST have, or is it just the desire? Can I do without it? Does it affect my life in any way? Would I die if i do not eat chocolate today:))?

So the issue of money spending and saving is a bendable one and kids need to learn to make decisions about how, when and why to spend their money.

Still haven't started the money earning program, but my son is almost 10, so it is probably time to let him know money does not grow on trees:).

Plenty of art galleries around the UK are free, and even put on crafty workshops that the kids can take part in. To get them really engaged in what s hanging on the wall, it s a good idea to focus on just one artist or theme for the day, to avoid overloading.

These are really useful tips, eldest seems to be getting the hang of it as he questions if things are worth the investment or finds a cheaper alternative to save a few quid 🙂 But I like having more ideas to help educated both my boys x

I am quite lucky that Kian is good at saving – he has just got his first job though so it will be interesting to see where he spends his money

I think you are right about educating our children with our behaviour. We often talk about money decisions and I have been known to explain even quite small decisions in the supermarket.

Fab post. I have avoided cards like go henry yet as I wanted the boys to understand actually cash first.

A really interesting post. I must admit, like you, I use a card scheme and the boys get £5 each week and I ask them to do some jobs to help 'earn' that money. It does give them an idea of money and when they want something, they do have to save for it which is such an important lesson for them