We do a full monthly budget review at least every six months but more often than not, we’ll try and do it every three months so we can keep a close eye on what’s happening with our money and make changes if we need to.

I thought I’d take you through the process and give you a bit of an update on our budget today as it must be a good year or so since I’ve shared something like this.

First up, I always print out two copies of my free monthly budget planner which you can find here. There are two versions to choose from – a plain and a pretty version but obviously, I always go for the pretty one.

Did you notice I said that I printed two copies out? I’ll explain more about that further down but for now, I set one aside and just work with one copy.

Income Details

This is the easy part! It’s just our wages and child benefit that goes into this section and those figures don’t change very much from month to month.

I don’t include any blog income in this section as any money that I do earn from blogging isn’t guaranteed and I’d never want to be reliant on that income as it would take the fun out of blogging for me. Any blogging money is allocated elsewhere for things like holidays and other treats usually.

Monthly Outgoings

Mortgage

I’ve shared a few times that we are currently overpaying our mortgage by £300 a month which is something we’re doing as I want to be mortgage-free before I’m 50. We stopped this in January and February but we’re back on track now with the overpayments.

We’re due to look at re-mortgaging shortly and need to take some advice about whether we should continue to overpay or look to reduce the term of the mortgage officially so our payments are higher.

Gas and Electricity

We switched to Bulb last year and have been over the moon with them since we switched. I’ve had two emails from them letting me know that they’re reducing prices which is something that I’m definitely not used to – if anything I’m used to being told prices are going up. They’ve saved me money on what I was paying before and I love the idea of knowing that all of the energy I use is carbon neutral.

I’ve recommended them to you guys and I know that lots of you have also switched to them and are equally as happy as I am with them. If you do fancy changing to them, you can use my referral link if you want and we’ll both get £50 off our bills.

I don’t think we can save any more off our bill at this point unless we switch to a smaller company that doesn’t have as good a reputation as Bulb who are rated 9.6 out of 10 on Trust Pilot so we’re going to stick with Bulb right now which makes that part of my budget review easy for now.

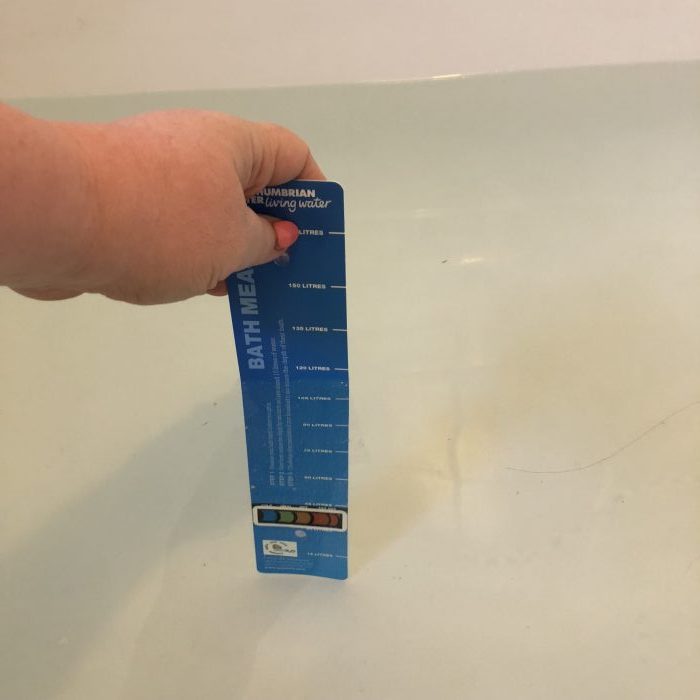

Water

We’ve made amazing progress with our water consumption which has had a fantastic effect on our monthly water bills. I’m pretty sure that there is nothing else we can do to save on our water costs each month as we’re already below average for a family of four.

Insurances

We pay our home insurance and one of our car insurances in full each year so that’s not included in our monthly budget although we do save money each month so we have the money available to pay it when it’s due. The other car insurance is still paid monthly which is something we plan to change but because the premium is due in January we always decide to stick to monthly as there’s usually something else we need the money for at that time of year.

We still have boiler cover with British Gas even though we have a level of this cover on our home insurance policy and I know I should look into cancelling or reducing the cover but it’s less than £15 a month and the British Gas boiler cover has saved us a couple of times. They’re so quick to come out and we’ve never had a problem so I’m really reluctant to get rid of it for something we’re not sure will be as good.

Breakdown cover also falls into this category for me and if you caught last week’s five frugal things post then you’ll have seen that I have opened a new current account specifically for the rewards you get. For £13 a month we get breakdown cover on both cars and annual family travel insurance which is fantastic and now means that we can cancel the cover we already have in place for these things saving us more than the £13 a month we’ll be paying.

TV, Phones and Broadband

This is the one category that we *could* cut down on significantly if we ever needed to as we currently pay a fair amount in this section. We have a TV and Broadband package with Virgin Media which includes their top level broadband AND Sky Sports and we also have Netflix and Amazon Prime which we use mainly for Amazon video.

Yes, I’d rather pay less than we pay here but I’m actually OK with it as we make good use of all of it so we definitely get our money’s worth. This is what I consider as our ‘splurge’ each month and although I could cancel or downgrade most of it, I don’t feel like I need to at this point – if ever I did though, this lot would be the first to be reviewed.

We have phones on EE with great SIM only deals as we tend to buy phones outright rather than go on contract and we did recently pop into the shop to see if they could get us a better deal (which they did) so I’m confident that there’s no saving to be had here at the moment.

Cars

We currently have two cars – both paid in full when we bought them so we have no outstanding car finance or anything like that.

One is a lovely Vauxhall Mokka which is our main family car and one is a slightly less lovely elderly Citroen C3 (see above) which I now drive to and from work as we don’t want to add all the extra miles onto the Mokka (80 miles a day soon adds up). Our services and MOTs are all included with the Mokka so we don’t worry about that too much at the moment but the Citroen is starting to show it’s age and is at the age where it’s starting to need more and more work done on it so the cars section of this budget may change imminently. It’s actually the reason why we’ve reviewed it in detail this week – we want to be sure of what we can comfortably afford if we’re going to look at a new car. The Citreon cost £600 ish from eBay though and has been amazing – so so worth what we paid for it!

Breakdown cover and car insurance have been covered above so that leaves car tax, which I pay for monthly at the moment and petrol which is currently a touchy subject. My petrol costs have shot up since Christmas when I moved from one site to another for work and it’s currently costing me much more than I would like. I can’t do too much to control this other than make sure I keep an eye on local costs so I know where the cheapest petrol station is.

Subscriptions

We don’t have too many monthly subscriptions but the ones we have, I’ve reviewed to make sure we’re still getting our money’s worth from them.

The only one I’m not convinced about is the family Apple music subscription that we have as both myself and Mr Frugal use the Amazon Music that comes with Prime. The kids use it all the time though and at some point, we did reduce their pocket money so they were officially paying it between them but somewhere along the line we seemed to forget about that and they’re back to what they were getting before.

Other budget stuff

- We have Standing Orders set up for the kids pocket money so they can manage their money better. At this point, Miss Frugal gets what we get as her part of our family allowance payment paid into her bank account on payday.

- I pay £50 a month into my employers Share Save scheme which is then matched by them but that comes directly out of my wage.

- Our Emergency fund is not currently looking that great if I’m honest as we dipped into it for some non-emergencies so that’s something we absolutely need to put right ASAP.

- We currently have a temporary expense which is pretty costly – we’re paying a tutor to help Miss Frugal with her English GCSEs and although it’s worth every penny, it’s far from cheap at £30 an hour each week. It’s a short term thing though and has helped her more than I could tell you as she was really struggling for some reason with parts of it which was, in turn, having a knock-on effect on her confidence in the subject overall. At the parents evening at the end of last year, it seemed like we’d be lucky to get a Level 5 but now, just four months later, she’s just a few marks away from a Level 7. I’m not a pushy parent and if she was only capable of a Level 5 and tried her best then that would be absolutely OK but she was trying so hard and it wasn’t clicking so when she asked if we would be able to get her a tutor I knew it wouldn’t be a waste of money and it definitely hasn’t been.

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter, BlogLovin or Networked Blogs and I’d love to see you over on my Facebook page and on Instagram. You can find out more about me here.

Pin my monthly budget review for later:

Logging you in...

Logging you in... Loading IntenseDebate Comments...

Loading IntenseDebate Comments...